Spotlight falls on potential tax changes as General Election called

After much speculation about when The Prime Minister would call a General Election, Rishi Sunak surprised many with his announcement in recent days that it would take place on 4 July. We had expected an Autumn Election, but we’ve ended up with a Summer vote instead.

Of course, as with all General Election campaigns, people want to know what it means for their income and what tax changes are likely to occur. With Labour’s consistently vast lead in the opinion polls (around 20 points ahead on average) showing no sign of abating, many are focusing on what a Keir Starmer-led Government might do. One area that has been highlighted is his policy on introducing VAT on private school fees – something Rachel Reeves, the Shadow Chancellor, has consistently spoken about, but which the Conservatives are against.

We’ve seen the Conservative Government make National Insurance cuts in the recent Budget and Autumn Statement, and some signalling of an ambition of scrapping NI entirely in the very long run. Chancellor Jeremy Hunt has said early on the campaign trail that he wants to make further cuts. So perhaps that trend would continue if the party regains power.

We’ve not had any major statements on income tax yet, though Labour has been saying in the last 12 months that it would not be looking to raise either income tax or national insurance.

One major difference between Labour and the Conservatives might be on IHT. It’s been talked about so many times, but will this be the time when the Conservatives commit to scrapping the tax, as has been debated frequently Labour on the other hand has said it’s opposed to its abolition.

However, at the time of writing, none of the major parties have published a manifesto so we don’t know quite yet what the major tax pledges are going to be. Watch this space!

July tax credits deadline prompts payment warning

Nearly one million people need to be aware of a looming tax deadline, coming on 31 July.

It’s that time when tax credit renewal notices are sent out. There are about 730,000 tax credits customers who should get their letter by 19 June, if they haven’t already. Most claims get automatically renewed but up to 10,000 may need to submit their claim for renewal. Without doing so, there is a risk of payments being stopped. The process can be completed either through the HMRC app or its website.

HMRC stated: ” If customers fail to renew by the deadline, they risk their payments being stopped and having to repay any overpayments. The 2024 to 2025 tax credits notices may show predicted payments for the tax year 2025 to 2026 – these are automatically generated and should be disregarded. ”

New Scottish tax sparks petition to recall powers

If you’re a Scottish resident, you’re no doubt aware that from April a whole new band of tax has taken effect.

The new Advanced Income Tax band , coming in at a 45% rate , applies on annual income between £75,000 and £125,140. An additional 1p has also been added to the Top Rate of tax . It’s gone up from 47% to 48% for income over £125,140 .

The move, unsurprisingly, is not universally popular and it has triggered a new petition on the Government website to strip the Scottish Parliament of its powers to change income tax rates. Nearly 13,000 have signed so far.

Tax-altering powers were given to the Scottish Parliament as part of the Scotland Act 2012. But the campaign calls for change, which would bring tax in line with the rest of the UK and set by the British Parliament in Westminster.

Of course, with the General Election for the British Parliament in Westminster now set for 4 July, tax legislation is even more in the spotlight. Though elections for the Scottish Parliament are not happening at the same time, with the next set to take place in 2026.

The petition has already garnered enough support to mean it will receive an official government response, and if it reaches 100,000 would be considered for debate in the House of Commons.

If you’re a Scottish resident or business owner or you’re looking to relocate to Scotland and need help to understand the tax implications, do drop us a line.

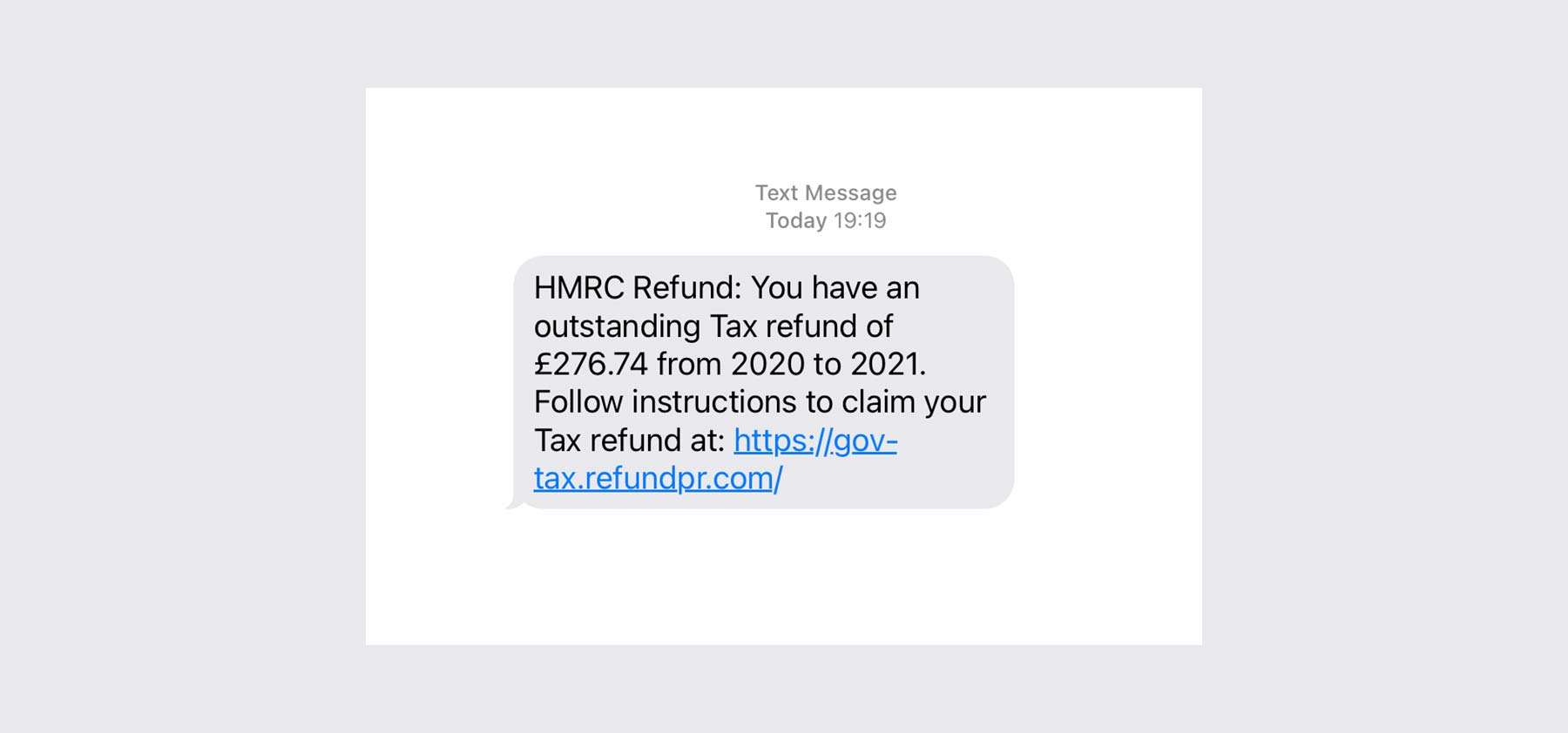

HMRC issues ‘tax refund companies’ alert top

HMRC is warning against being hooked by self-professed ‘tax refund companies’ claiming they can help you reduce your tax bill.

The organisation is running a campaign to highlight that some of these ‘tax experts’ will offer to make expense claims ” on your behalf, just so they can claim a commission – even if it turns out you aren’t eligible to claim ” .

” If someone promises easy money and it sounds too good to be true, it probably is, ” HMRC says.

” Handing over your personal information could mean you end up having to pay back the full amount of any invalid claim made on your behalf, including any commission an agent has already taken. ”

It advises people to undertake thorough research. Of course, this is why it’s so important to speak to a verified, qualified, experienced accountancy professional about anything to do with your tax-related matters.

If you think you may be eligible for a tax refund, have a question, or want to understand more about an aspect of your tax obligations, please get in touch with us and our team will be very happy to offer informed guidance.

June Questions and Answers

Q: As part of my professional role, I belong to a professional body, for which I pay membership fees each year. It’s becoming somewhat expensive to keep it going but it is nonetheless an important part of my job. Somebody mentioned they had claimed tax relief for the membership fees. Is this possible?

A: Yes, it is true that you can claim tax relief on professional membership fees. To be eligible for this, the membership is important to have for you to do your job, according to the official HMRC guidance. You can also claim relief on annual subscriptions you pay to approved professional bodies or learned societies, ” if being a member of that body or society is relevant to your job ” , the guidance states. But if you didn’t pay yourself – for example, your employer stumped up the money for the fees – then you can’t claim the relief. The other key thing to bear in mind is that your professional body must be on the approved HMRC list. To check if yours is, please visit this page .

Q: The turnover of my business has been no higher than £68,000 over a 12-month period since we started but has now risen to £91,000. It reached this point on 5 May 2024. What do I need to do about VAT registration?

A: Once your total VAT taxable turnover for the last 12 months goes above the threshold you must register for VAT with HMRC. Up until April 2024 it had remained at £85,000 for seven years, but now in the new 2024/25 tax year, it has risen to £90,000. Although you can voluntarily register for VAT if you’re below this amount, it doesn’t sound as if your business has taken that approach previously.

But now your turnover is at £91,000, you need to register with HMRC within 30 days of the end of the month that you went over the threshold. According to HMRC: “Your effective date of registration is the first day of the second month after you go over the threshold.”

So, in your case, it means you will need to have registered by 30 June 2024 and your effective registration date will be 1 July 2024.

For any business which realises it’s going to go over the £90,000 mark in the next 30 days, you have to register by the end of that period. So, in that example, say your company (previously not VAT-registered) brings in a new £150,000 deal on 1 June, with payment coming to you within that same month. You would have to register by 30 June.

Lastly, just to clarify what HMRC defines as turnover. It says this is “the total value of everything you sell that is not exempt from VAT.”

Q: We’re a fledgling business in the scientific sector with a turnover of under £500k at the moment and just 22 staff. We’re looking to make sure we claim the tax relief we’re entitled to under the Government’s Research and Development scheme. What do we need to know?

A: It sounds like you are in a position to claim Research and Development (R&D) tax relief but let’s look at what you need to do for your project to meet the necessary criteria. What qualifies as R&D? HMRC states that it “must be part of a specific project to make an advance in science or technology”.

Further stipulations are that your project must be connected to either your current trade or one you plan to set up following the results of the research. The scheme also requires you to explain a number of things, including how it is advancing the field of knowledge, how it’s overcoming a “scientific or technological uncertainty” and also why it could not “be easily worked out by a professional in the field ” .

The official guidance also states that “your project may research or develop a new process, product or service or improve on an existing one. ”

If you’d like further help with understanding R&D tax relief , please do get in touch with our team and we would be happy to discuss the full details.

June Key Dates

1st

– Multiple Dwellings Relief is to be abolished.

19th

– For employers operating PAYE, this is the deadline to send an Employer Payment Summary (EPS) to claim any reduction on what you’ll owe HMRC.

22nd

– Deadline for employers operating PAYE to pay HMRC. This is also the quarterly deadline for businesses that pay per quarter. For those paying by post, the deadline is 30 June.

30th

– Corporation Tax Returns are due for companies with year-end of 30 June.

Book a No-obligation Call or Meeting

Book a No-obligation Call or Meeting

Book a Call or Meeting

Book a Call or Meeting