Inheritance tax break that could lure expats back to the UK

Changes introduced by Chancellor Rachel Reeves on April 6 mean Britons who have lived abroad for 10 years are no longer subject to UK inheritance tax on their global assets.

The ‘non-dom’ tax regime (the previous system allowing UK residents to avoid tax on foreign income) has been replaced by residency-based taxation. This means that those who have spent a decade overseas can return to the UK for up to nine years without being liable for inheritance tax on their worldwide assets. Any UK assets will still be subject to death duties.

It is suggested that the new rules allow wealthy individuals to strategically manage their tax liabilities based on their residency status. Countries like Italy, Switzerland, Monaco, and the UAE are popular among Britons seeking favourable tax regimes.

The UK residency test for tax status considers you a UK resident if you spend 183+ days in the country per tax year. You may be considered a non-resident if you spend fewer than 16 days in the UK, or 46 days if you were not a UK resident in all of the previous three tax years.

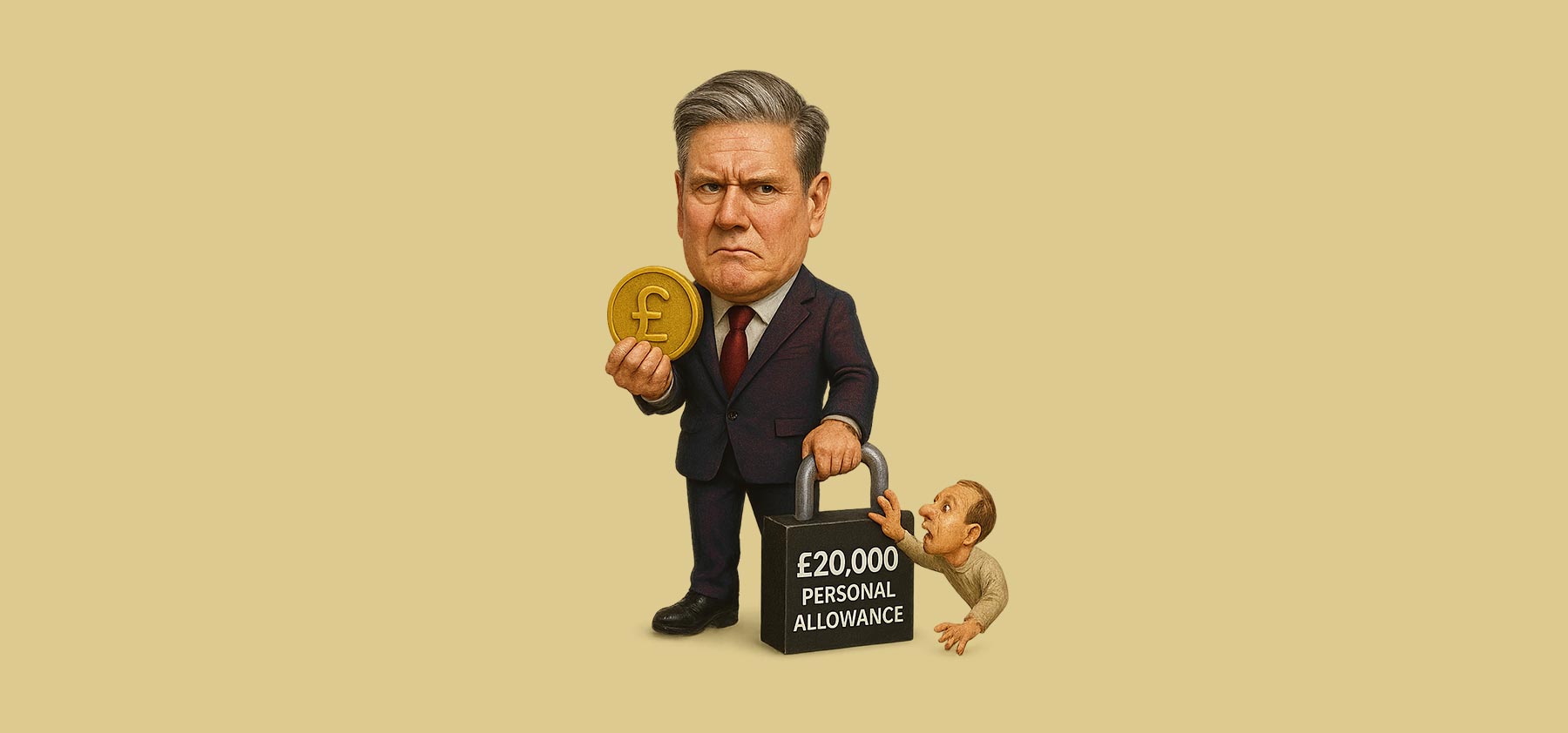

The Government refuses to increase the annual Personal Allowance to £20,000

Parliament debated a petition calling for the income tax threshold to be raised from £12,570 to £20,000 to allow people to keep more of their earnings. The petition, signed by over 250,000 people, was spearheaded by pensioner Alan Frost, who described it as a “cry for help.”

MPs acknowledged concerns over increasing tax burdens on low earners and pensioners but stated that raising the threshold would cost between £40 billion to £90 billion annually. Labour’s James Murray, Exchequer Secretary to the Treasury, rejected the proposal, citing concerns that it could jeopardize funding for defence and the NHS.

The ongoing income tax threshold freeze, first introduced in 2021, has led to more workers falling into higher tax brackets due to “fiscal drag. The Institute for Fiscal Studies (IFS) estimates that, by 2025-26, an additional 1.3 million people will enter the tax system, with 1 million pushed into the 40% higher-rate band.

Despite growing support, the Treasury has firmly rejected the petition, arguing that raising the threshold would significantly reduce tax revenue needed for public services. Given the regent U-turn on the winter fuel allowance, it remains to be seen if the Government will change its mind on the Personal Allowance threshold.

Reeves under pressure to create wealth tax

The financial pressures facing Chancellor Rachel Reeves continue to mount, particularly regarding a projected £57 billion shortfall in the country’s finances.

Public sentiment is shifting towards tax increases on wealthier individuals, with 48% in a recent poll (by BMG Research) supporting higher income taxes on those earning over £125,000. 29% backed a rise in capital gains tax whilst 26% supported an increase in corporation tax.

Alternative tax proposals include a 2% annual levy on assets over £10 million, which it is claimed could generate £24 billion annually. Wealth taxation is emerging as a potentially more palatable option, focusing on net wealth, including property and investments.

The National Institute of Economic and Social Research warns that Reeves must either cut public spending or raise taxes to meet Labour’s fiscal rules by 2029. The political rise of Reform UK adds further pressure, as broad tax hikes face opposition, especially inheritance tax.

Reeves urged to launch tax raid on landlords

Labour MPs and influential advisers are urging Chancellor Rachel Reeves to ‘launch a tax raid’ on landlords as part of efforts to fill a fiscal gap without breaking the party’s manifesto commitment against increasing taxes on ‘working people’.

There are three proposed tax measures:

– Charging National Insurance on Rental Income:

Unlike most earnings (from employment or self-employment), rental income is classified as passive and isn’t subject to National Insurance. Imposing NI on it would align landlords’ income closer to other forms of employment earnings.

– Introducing a Separate Tax Band for Rental Income:

This would create a distinct taxation category for rental income, potentially imposing higher rates to ensure the income is taxed in a manner consistent with other types of earnings.

– Levying VAT on Residential Property Lettings:

Applying VAT to rental income from residential lettings is another method proposed to increase government revenue from property investors.

This has naturally raised concerns from the landlord community: The National Residential Landlords Association argues that landlords are already paying income tax on rental earnings. Additional taxation could not only add complexity to the system but might also deter investment, potentially worsening the housing crisis.

However, some tax experts emphasize that taxing unearned income like rent more like wages could create a more consistent and equitable tax system.

July Questions and Answers

Q: I sometimes sell unwanted items online. Am I now liable to pay tax on any money I make?

A: There has been a rise in recent years of people selling old and unwanted items, particularly on digital platforms. If you do this on a casual basis, it is unlikely that you will need to pay any tax. The exception to this is if you sell a single personal item or collection for over £6,000 – HMRC will need to be informed to see if you need to pay Capital Gains Tax.

Some people buy and sell regularly on these platforms and HMRC considers that ‘trading’. However, if you make less than £1,000 a year, there is no tax due. If you’re making over that amount, HMRC will need to be informed. It is worth noting that online platforms are now obliged to share information with HMRC if you sell 30 items or more per year. But again, if you make less than £1,000 a year, you will not have to pay tax on it.

Q: For the first time in my life, I am paying tax on my pension. It is not a huge amount, but I am wondering if HMRC made a mistake, as my tax code has changed?

A: Without knowing your personal circumstances and the amounts involved, it is hard to say if HMRC has made an error. It is not infallible, though. You mention that you tax code has changed, so you should have received correspondence from HMRC explaining why this has occurred. If not, you should get in touch with them or you can, of course, engage with us to deal with HMRC on your behalf.

Given that the annual tax-free personal allowance of £12,570 is still frozen, it is probable that any increase to you pension income (state and private) has now taken you over the threshold. Many do not realise that pensions are taxable, and so you are likely now paying income tax on the proportion that is above £12,570.

Q: If the personal allowance is £12,570, why do I have to register as a sole trader if I’m making less than that each year?

A: This is an understandable question given that you do not need to pay tax on any money made below £12,570. HMRC’s rules state that if your gross annual income is over £1,000 then you must register as self-employed and submit a self-assessment tax return. This applies to individuals, not partnerships.

HMRC requires this so that it can check that sole traders are paying the correct amount of tax on their earnings, if applicable. They also need to maintain records on those who are trading for the purpose of providing the Government useful statistics on the state of the economy – how many sole traders are operating and how much they contribute to the economy, for example.

July Key Dates

1st

– Corporation Tax payments are due for companies with a year-end of 30th September.

6th

– Deadline for submitting P11D and P11D(b) forms for the tax year 2024-25.

19th

– For employers operating PAYE, this is the deadline to send an Employer Payment Summary (EPS) to claim any reduction on what you’ll owe HMRC.

– It is also the deadline for employers operating PAYE to pay HMRC by post, for June.

22nd

– Deadline for employers operating PAYE to pay HMRC electronically, for June.

30th

– Corporation Tax Returns (CT600 form) are due for companies with a year-end of 30th July.

Book a No-obligation Discovery Call

Book a No-obligation Discovery Call

Book a Free Discovery Call

Book a Free Discovery Call