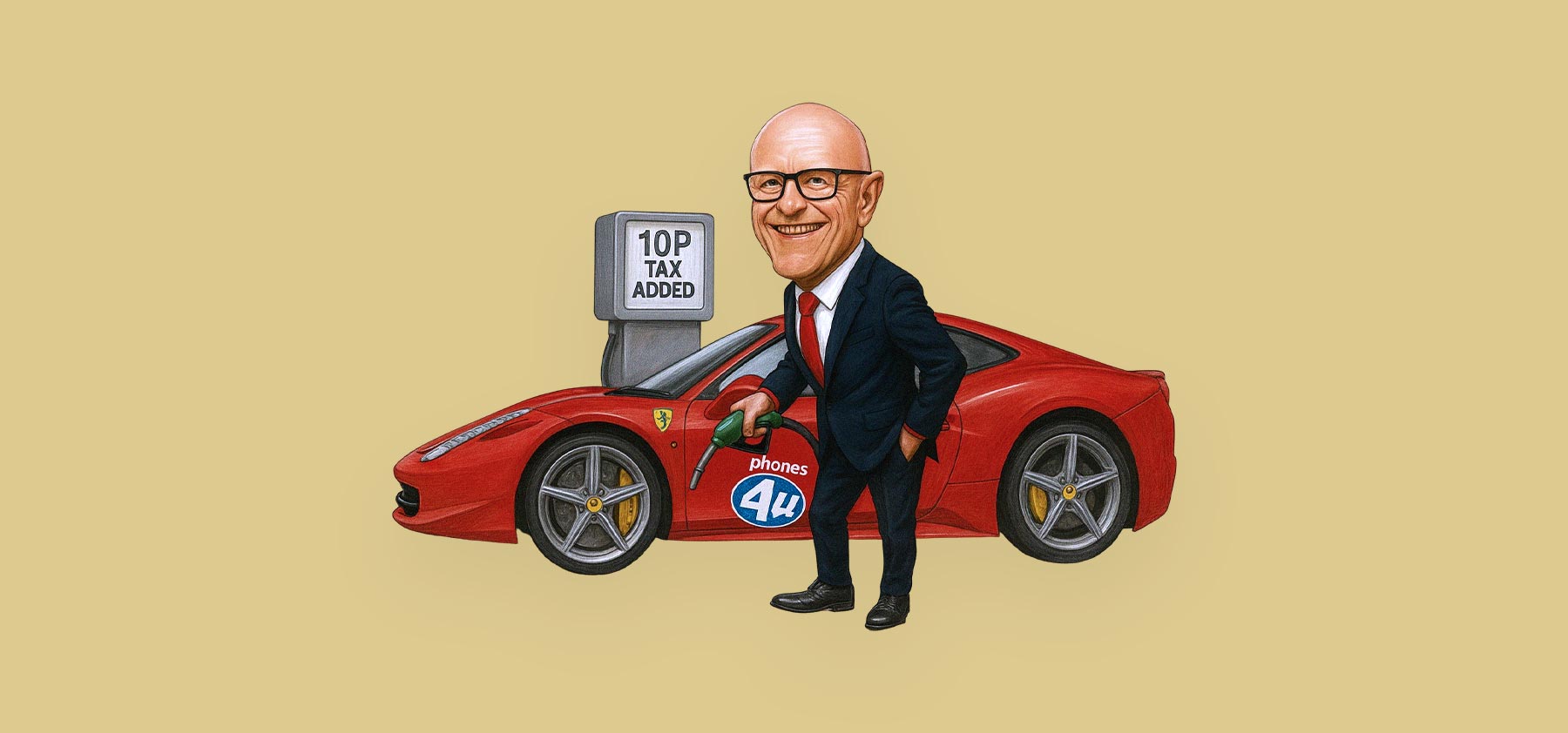

A new ’10p tax’ suggested to the Chancellor… by a billionaire

John Caudwell, billionaire and Phones 4u founder, has urged Chancellor Rachel Reeves to introduce a 10p per litre tax on petrol and diesel. He claims this could raise £20 billion for the Treasury and help avoid other unpopular tax hikes. His rationale behind the proposal is that fuel prices have dropped from ~190p to ~140p per litre, creating what Caudwell sees as fiscal ‘headroom’ for taxation.

It is true that fuel is now cheaper in real terms than at any point in the past 20 years. Factors contributing to the drop include: a decade-long freeze on fuel duty, a 5p temporary cut introduced in 2022, falling global oil prices and a stronger Pound.

Caudwell argues this would be less damaging than taxing sectors like farming. He also acknowledges the proposal would be unpopular but insists it’s a pragmatic solution to plug fiscal gaps without destabilising key industries.

Revealed – UK’s biggest deliberate tax defaulters

HMRC has named over 4,000 deliberate tax defaulters since 2015, collectively owing more than £1.5 billion. These individuals or firms were penalised for deliberate errors in tax returns or failing to meet tax obligations. Here is the sector breakdown:

Hospitality: 21% of defaulters (e.g. takeaways, pubs, cafes).

Construction & Trades: 19% (e.g. plumbing, plastering).

Recruitment/Payroll firms: 5 of the top 10 defaulters, owing £145 million.

Haulage & Freight: 112 defaulters owing £33.5 million.

Metals & Recycling: Notably concentrated in Yorkshire, with £60.4 million owed.

Other sectors include adult entertainment (£783k) and barristers (£523k).

The campaign aims to deter tax evasion and increase transparency. HMRC publishes names only after penalties are final. Defaulters can avoid being listed if they fully disclose their defaults. HMRC also stated that the list only includes those penalised under civil procedures and does not include criminal convictions for tax fraud.

The think-tank TaxWatch warns that the £1.5bn figure may be just the ‘tip of the iceberg’, especially with offshore income potentially escaping HMRC’s radar. They added that “HMRC has the power to fine and name tax advisers who deliberately conceal documents or provide misleading information about their clients’ affairs. Yet between 2020 and 2024 we found that HMRC started substantive investigations against fewer than five dishonest tax advisers in each year, and at the moment it doesn’t publish the names of any tax advisers fined for dishonesty.”

Chancellor considers a new property tax to replace stamp duty

Chancellor Rachel Reeves is exploring a new proportional property tax targeting homes worth over £500k. This would replace stamp duty for owner-occupied homes, but not for second homes. The tax would be paid upon sale, with rates set by central government and collected by HMRC.

Officials are also studying a local property tax to potentially replace council tax in the future. This tax reform would likely require Labour to win a second term, as implementation would take longer. The move aims to tap into the surge in property values and address inequities in the current system, which is based on 1990s valuations.

It could help raise revenue without breaching Labour’s pledge not to increase taxes on working people. The proposal aligns with calls from within Labour for more wealth-based taxation.

There has been divided public reaction to these proposals. Many have pointed to regional disparities, arguing that in areas like London and the Southeast, £500k doesn’t equate to wealth due to high housing costs. They suggest raising the threshold or applying regional adjustments. Some fear middle-class families and pensioners could be unfairly impacted.

Others support taxing unearned property wealth to address generational inequality. Advocates say it could help rebalance the housing market and target wealth more effectively. Critics warn of unintended effects like reduced housing mobility and discouraged downsizing. Concerns were also raised about homeowners increasing asking prices to offset the tax.

Car tax update sees a 400% hike in costs for some

Since April 2025, HMRC has reclassified double cab pick-up trucks as cars rather than commercial vehicles. Previously, pick-ups with payloads over 1,000kg were taxed as commercial vehicles, allowing drivers to pay a fixed Benefit-in-Kind (BiK) rate – regardless of luxury level. These vehicles will now be taxed based on CO₂ emissions, placing many in the highest tax brackets due to their size and poor aerodynamics.

Only double cab models with rear seats are impacted; single cab commercial variants remain unaffected. For example: a Ford Ranger Wildtrak driver in the 40% tax bracket will see annual BiK tax rise from £1,608 to £8,322. This represents a 400%+ increase for many motorists.

The change was made to address disparities, such as drivers paying more tax for a small city car than a three-litre diesel high-emission pickup. It is believed by some that drivers were using the tax benefits intended for genuine businesses to subsidise their choice of the most polluting and inefficient diesel pickups.

The update has sparked discussion about the equity and logic of emissions-based taxation for multi-purpose vehicles. The National Farmers’ Union has warned that farmers rely on double cab pick-ups every day to go about their farming duties as there are few alternative vehicles. They are not being used as luxury items but will now impose an ‘unaffordable tax burden’ on already struggling farmers.

September Questions and Answers

Q: My teenage child has a summer job this year. As they are under 18, do they need to worry about tax on what they earn?

A: Contrary to popular belief, children are eligible to pay tax just like adults. They rarely do because if they do earn anything, it is usually under the annual Personal Allowance of £12,570.

Some important things to note, though, are that under-18s should be paid a minimum of £7.55/hour and will need to pay National Insurance if earning over £242/week and aged 16+. Children (from age 14) can only work part-time until they are 18 (in England – it is 16 in Scotland, Wales and Northern Ireland). There are some exceptions, for example under-14s can work if they are performers or models.

Q: I have been cohabiting with my long-term partner for decades, but I’ve heard that could put us at a disadvantage when it comes to Inheritance Tax compared to couples who are married. Is this true?

A: Unfortunately, that is true. Married couples and civil partners get what is known as ‘Spousal Relief’. This exemption means that when one partner dies, their entire estate can be left to the surviving partner without incurring any inheritance tax (IHT). Their personal nil-rate band (of £325k) also gets transferred, meaning when the surviving partner passes away, they can pass on £650k’s worth of assets free of IHT.

If a primary residence is involved, the £175k residence nil-rate band also gets transferred, meaning the surviving partner will have an allowance of £350k if they pass the property onto direct descendants on their death.

Cohabiting partners are unable to benefit from this pooling of allowances, so there will likely be a larger IHT bill to pay when passing on assets upon their death.

Q: I’m in my early sixties and wondering if I should use my pension tax-free lump sum to pay off my mortgage?

A: This is a difficult question to answer, without having full knowledge of your financial situation. The main things to consider are:

The mortgage term and interest rate

The size of your pension pot and your retirement income need

If you believe that your pension investments will bear a lower return than your mortgage interest rate, then it would be worth clearing down your debt as your savings (pension) are growing at a slower rate than your costs (mortgage).

However, this reduces your pension pot which will affect long-term income. But you may prefer the peace of mind that you are mortgage free.

Please get in touch so that we can discuss your situation and explore the options available to you.

September Key Dates

1st

– Corporation Tax payments are due for companies with a year-end of 30th November.

19th

– For employers operating PAYE, this is the deadline to send an Employer Payment Summary (EPS) to claim any reduction on what you’ll owe HMRC.

– It is also the deadline for employers operating PAYE to pay HMRC by post, for August.

22nd

– Deadline for employers operating PAYE to pay HMRC electronically, for August.

30th

– Corporation Tax Returns (CT600 form) are due for companies with a year-end of 30th September.

Book a No-obligation Discovery Call

Book a No-obligation Discovery Call

Book a Free Discovery Call

Book a Free Discovery Call