£38million of tax overpayments refunded

Have you overpaid on your pensions tax? HMRC has released information showing that £38million worth of repayments were issued to thousands of savers (aged 55 and over) in the final quarter of 2023. More than 12,000 reclaim forms were processed.

In the main, it was individuals accessing their pensions flexibly who were impacted. The unexpected tax bills have arisen due to an ’emergency’ tax code applied to their first withdrawal.

Analysis by investment broker AJ Bell indicated that since 2015, approximately £1.2 billion has been repaid to savers who were taxed too much. The average refund in the last quarter of 2023 amounted to £3,200, the same research stated.

There were calls in the national media, following the release of the information, for tax system reform to accommodate flexible pension access, which has been available since age 55.

HMRC told the FT newspaper that nobody overpays tax due to taking advantage of pension flexibility. It assured anyone affected by the emergency tax code issue they will receive an automatic repayment. Individuals can also reclaim earlier for overpaid tax by filling out the appropriate forms, HMRC officials added.

To watch the Budget, most mainstream UK news channels will have coverage, with it being broadcast live on the Parliament website and BBC News website. The speech is likely to begin at 12:30pm and run for around an hour.

Budget to bring tax and mortgage changes?

It’s nearly that time again when the Chancellor of the Exchequer rises to his feet to address the House of Commons to deliver the latest Budget.

This Spring announcement – set for 6 March – is earlier than typical, with a General Election looming sometime later this year, in all likelihood. The Government has to go to the polls by January 2025 at the very latest.

The news that the UK has slipped into a technical recession (two quarters of consecutive negative growth) has complicated matters for Jeremy Hunt. He will undoubtedly want to offer some kind of tax cuts to woo voters to the Conservative party, with dire opinion polling consistently putting them far behind Labour. Yet, how much wiggle room is there in the public finances, given this news on the recession?

At the Autumn Statement, some commentators had expected, judging by hints from Mr Hunt, that income tax might fall. But it was actually a 2p cut to National Insurance contributions that was the big reveal that time.

Some analysts and political pundits are expecting that the Chancellor will announce a cut to the basic rate of income tax, despite the fact that even a 1p reduction could cost £7bn, according to the Resolution Foundation.

Yet again, Inheritance Tax changes could be on the agenda. Time after time we see speculation that there will be a significant move in this area of tax policy, but it’s failed to materialise. A complete abolition of IHT would hit the coffers to the tune of £7bn, the IFS has calculated.

Another potentially eye-catching move, would be a new policy for 99% mortgages to help first time buyers and stimulate the housing market. That is on the cards, if a Financial Times report proves to be accurate.

The OBR, an independent office monitoring government spending, will publish a report on the economy’s performance later the same day.

To watch the Budget, most mainstream UK news channels will have coverage, with it being broadcast live on the Parliament website and BBC News website. The speech is likely to begin at 12:30pm and run for around an hour.

Scammers target self-employed with fake tax refund promise

A surge of bogus tax refund phishing scams is feared by HMRC officials.

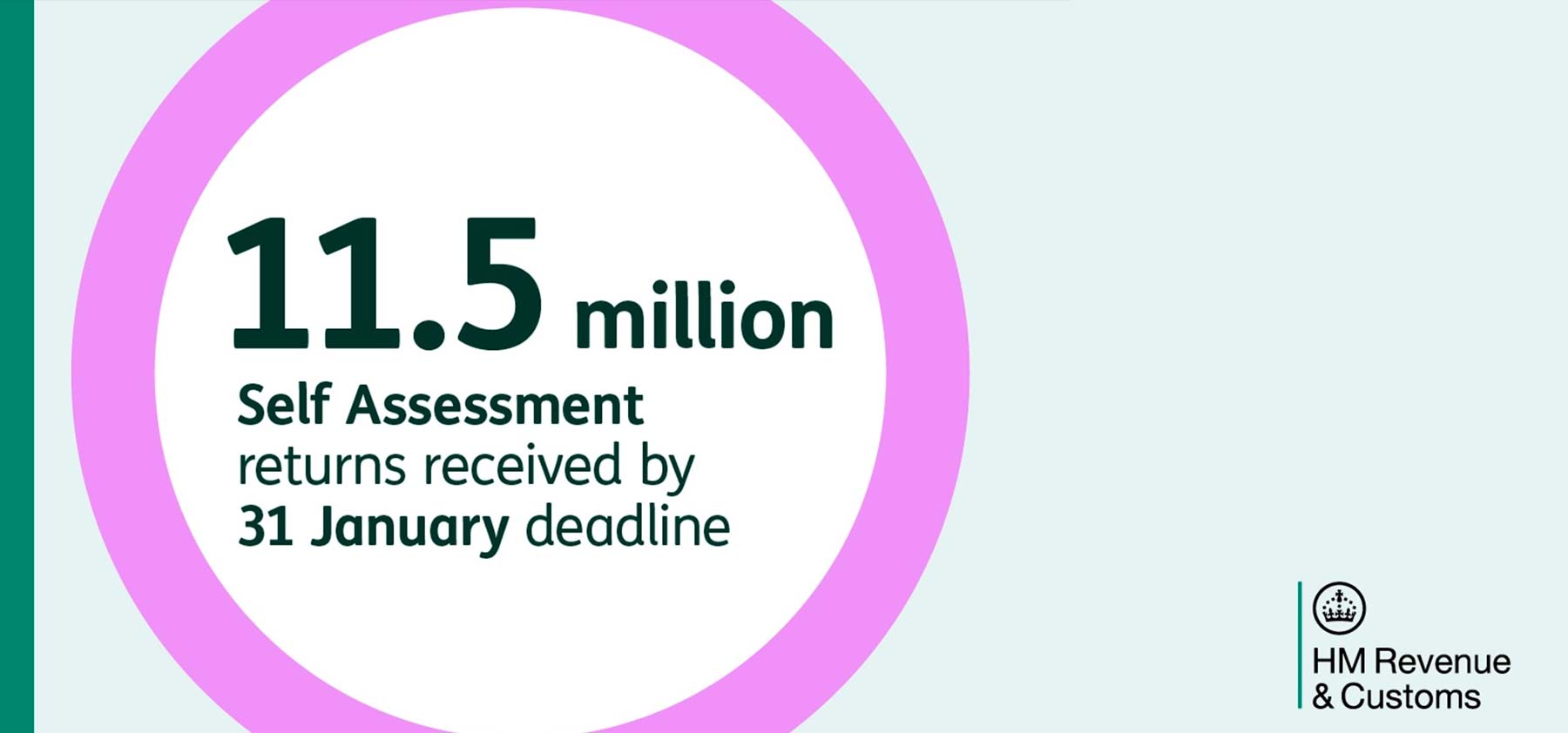

The Government body has warned self-employed people to watch out for fraudsters who are likely to want to target the 11.5 million or so who have just recently sent in their Self-Assessment tax returns.

Scammers will attempt to dupe people about tax rebates by email, phone or texts that mimic government messages to make them appear authentic.

Designed to use personal details for selling on to criminals, or to access people’s bank accounts, these attempts to lure in the self-employed have been witnessed in large numbers in the last year or so, judging by HMRC’s latest announcement.

Officials said they had replied to 207,800 referrals from the public of suspicious contact in the past year to January – up 14% from the 181,873 reported for the previous 12 months. More than 79,000 of those referrals offered bogus tax rebates.

HMRC said it also reported 26,443 malicious web pages to internet service providers to be taken down in the year up to January 2024. These sites aim to deceive taxpayers and steal personal information or money. This was a 29% increase from the 20,385 referred by HMRC for removal the previous year, officials said.

Kelly Paterson, HMRC’s Chief Security Officer, said: “With the deadline for tax returns behind us, criminals will now try to trick people with fake offers of tax rebates. Don’t rush into anything, take your time and check HMRC scams advice on GOV.UK.”

The main advice from HMRC to point out here is that it would not send an email, text or make phone calls to you to say you are due a refund or indeed to ask you to request a refund.

Received anything suspicious as described in this news item? You can forward emails to phishing@hmrc.gov.uk or texts to 60599.

Record Self-Assessment returns, but estimated 1m miss deadline

The record number of taxpayers submitting Self-Assessment tax returns was beaten in January, it’s been revealed, with a new high of 11.5million being reached. That’s quite some number!

But, judging by the figures HMRC released, somewhere between 0.5million and 1.1million failed to send theirs in by the deadline of 31 January.

Of the 12.1 million expected to file for the 2022-2023 tax year 778,068 managed to file on the last day, with 61,549 submissions occurring during the peak filing hour and 32,958 filed in the final hour.

The key stats released by HMRC for this latest Self-Assessment Tax Return deadline were as follows:

– 12,187,811 Self-Assessment returns due

– 11,581,962 returns received by 31 January. This includes expected returns, voluntary returns and late registrations

– 11,027,962 expected returns received by 31 January

– 1.1 million estimated to have missed deadline

– 11,246,962 returns were filed online (97.11% of returns expected, following adjustments)

– 335,000 paper tax returns were filed (2.89% of returns expected, following adjustments)

Of course, as you would expect, HMRC advises anyone with outstanding tax to pay up immediately. There are various payment options available and guidance accessible online and through instructional videos. If you do have any issues surrounding Self-Employment tax returns, do drop us a line or give us a call.

March Questions and Answers

Q: I am thinking about buying some cryptocurrency but before I do, I wanted to understand the tax implications. What do I have to declare in terms if I do go ahead? Is it taxed in the same way as my income?

A: Cryptocurrency (Bitcoin, for example) has become a more and more popular investment in recent years. According to FCA figures, the number of consumers holding cryptocurrency has risen to 2.3 million – from 3.9% to 4.4% of adults. The median holding has risen from £260 to £300.

You would think the clue is in the name – currency. Surely, it’s money and taxable in the same way? No. In fact, it’s not considered currency by HMRC and is not seen as the equivalent of money. How is it treated? As a traditional asset. So, in most cases – certainly when we’re talking about an individual as we are with yourself, it counts as a personal investment. You will not have it taxed as income, but you will be liable to pay Capital Gains Tax when you dispose of any crypto assets you have.

It is different, however, if you received cryptocurrency from your employer as a form of non-cash payment. Then it would be liable to Income Tax and National Insurance contributions.

It’s worth noting another rare exception, which HMRC explains here: ‘there may be cases where the individual is running a business which is carrying on a financial trade in crypto assets, and they will therefore have taxable trading profits. This is likely to be unusual, but in such cases Income Tax rules would take priority over the Capital Gains Tax rules.

Although it might not be an immediate consideration for you, it’s also worth noting that crypto assets will be considered as property for the purposes of Inheritance Tax.

Lastly, anyone thinking of investing should be in no doubt that HMRC is keeping an increasingly close eye on cryptocurrency ownership. It’s been reported in the national press in recent weeks that a new wave of tax investigations has begun into crypto investors. If you want to dive into any more detail about the repercussions for CGT and other tax liabilities, do get in touch.

Q: My civil partner recently passed away and I’m now dealing with the financial implications of losing him. I’m trying to understand the Inheritance Tax situation; I didn’t believe I needed to act until a friend told me I may have to submit details to HMRC even if the full value of property and possessions is below the minimum required. The reason she said this was because my partner gave away some money – quite a substantial amount to friends and family in recent years. I’m informed that the ‘estate’ value is £310,000. What do I need to do?

A: Thanks for your question. The first thing to say is our sincere condolences for your sad loss. The issue of IHT can be somewhat controversial at times and one that gets batted around politically. It’s possible that at the Budget on 6 March we may get an announcement of changes from the Chancellor. However, you can afford to ignore that if it does crop up. It wouldn’t come into effect for some time, meaning it is not relevant for you. We need to look at the existing rules.

In your case, you say the value of the estate is £310,000. This puts it just below the threshold, which sits at £325,000. That means you won’t have to pay IHT. If your estate had been higher than that but your civil partner had left you everything above that figure, you also wouldn’t normally pay IHT anyway. And the same would apply if it were left to a spouse.

But the one thing that you may need to do still – and this is where your friend’s guidance is wise – is report the estate’s value to the tax man. You mentioned your partner had given away money in the last five years. This is the key bit. You will hopefully have a record of these donations/gifts to be able to work out a total. If the amount of money he gave away was £250,000 or more in the last seven years before death, HMRC requires you to send full details of the estate, even if no tax is due. It may not be relevant in your case, but the same rule would apply if he’d had foreign assets worth £100,000 or more.

You would also need to submit a full account if any of the following criteria (as stated by HMRC documents) applies:

– He was living permanently outside the UK when he died but had previously lived in the UK

– He had a life insurance policy that paid out to someone other than you and also had an annuity

– He had increased the value of a lump sum from a personal pension to be paid after his death, while he was terminally ill or in poor health

– He had agreed that property he gave away during his lifetime would be part of their estate rather than pay a pre-owned asset charge

– He gave gifts that were paid into trusts

– He held assets worth over £250,000 in trust

– He held more than one trust

Just for the sake of anyone else reading this who finds themselves in a different position – ie you’re above the threshold – here’s an example of what it might look like:

Your estate is worth £500,000 and your tax-free threshold is £325,000. The Inheritance Tax charged will be 40% of £175,000 (£500,000 minus £325,000).

Any other questions on the estate or IHT, please do call our office.

Q: My brother has recently suffered a severe accident during which he has suffered damage to his eye. His vision has been badly affected. It’s not yet clear how much of his sight he will recover and how long term the problem is. Looking at the worst-case scenario, I’m investigating what help he may get from a tax perspective. Is there anything?

A: Firstly, we’re very sorry to hear about this terrible news. There are many difficult things of course to cope with in this situation but purely from the perspective of financials that you’re enquiring about, there may be a little help available. If you haven’t come across it before, look up ‘Blind Persons Allowance’. This is an extra amount of tax-free allowance that goes on top of the standard personal allowance that everyone has. The figure has risen in 2023/24 to £2,870 (previous year being £2,600). It’s worth noting that if he does not earn enough to use all of his allowance or doesn’t pay tax (now or in future) he can transfer the Blind Person’s Allowance to his spouse or civil partner, if he has one. To take a step back, anyone can claim this allowance if both of the following are correct:

– You’re registered with the local council as either blind or severely sight impaired

– You’ve got a certificate that says you’re blind or severely sight impaired. It could be a similar document from a doctor

The rules in Scotland and Northern Ireland for eligibility are slightly different. You can claim the allowance if both of these points apply:

– You cannot do work for which eyesight is essential

– You have a certificate that says you’re blind or severely sight impaired (or a similar document from your doctor)

The best way to make a claim is to call HMRC on 0300 200 3301.

March Key Dates

1st

– Due date for Corporation Tax payment for companies with a year-end 31 May.

6th

– Chancellor announces Spring Budget.

19th

– For employers operating PAYE, this is the deadline to send an Employer Payment Summary (EPS) to claim any reduction on what you’ll owe HMRC

22nd

– Deadline for employers operating PAYE to pay HMRC. This is also the quarterly deadline for business that pay per quarter. For those paying by post, the deadline is 19 March.

31st

– Corporation Tax Returns are due for companies with year-end of 31 March.

Book a No-obligation Discovery Call

Book a No-obligation Discovery Call

Book a Free Discovery Call

Book a Free Discovery Call