Claiming employment related expenses

There is a very limited range of expenses that employees can claim, but these can include the flat rate deduction (£6 per week) for working from home, if you are required to work from home, have no alternative place to work at, and your employer doesn‘t pay you a home-working allowance. You may also be able to claim uniform or tool allowances, which are specific to your trade, and claim mileage ( at 45p per mile) when you use your own vehicle while on a business journey.

You can claim for these employment -related expense in one of four ways:

– Include the expense on your self-assessment tax return

– Telephone HMRC, but you can only do this if you have made a similar claim in an earlier year.

– Complete and post a paper P87 form, which you can download from gov.uk

– Use the online P87 service through your online personal tax account on gov.uk.

You must use an approved version of the P87 form, not a substitute form or a letter

HMRC has realised that the new paper form P87 is not being completed in full by many taxpayers, so it has changed the rules to require the following sections of form P87 to be completed:

– Employee‘s name, date of birth, and home address including the postcode

– Employee‘s national insurance number

– Amount and description of the expense claimed

– PAYE reference of the employer

Where flat rate uniform or tool allowances are claimed, which are specific to defined industry sectors, you need to also include a description of the industry you work in.

If the form P87 doesn‘t include the required information it will be rejected.

Beware of electronic sales suppression

Electronic sales suppression (ESS) is the use of software or hardware tools to manipulate the sales recorded by an electronic point of sale (EPOS) device, such as a shop till.

Traders may think that HMRC won‘t find out about the sales hidden using ESS tools as the transactions are put through the till as normal, but selected sales are not recorded or are deleted.

To ensure the trader‘s bank receipts match the total amount of sales recorded by the till, the card payments for those missing sales are routed through an offshore bank account. In this way both the record of the sale and the revenue disappears. The use of ESS is the modern equivalent of cash-in-hand sales which are never put through the business‘ books.

You should check that your EPOS software used in your tills is legitimate and doesn‘t include a facility to manipulate the sales recorded.

If HMRC discovers that your business uses or possesses an ESS tool you will receive a letter asking you to remove the ESS tool and prove that you have done this. If you do not remove the ESS tool when requested you may be charged up to £1,000 as a fixed penalty, and additional penalties of up to £75 per day until you can convince HMRC that the ESS tool has been removed.

HMRC will also charge penalties for any inaccuracies and late tax payments where tax has been underpaid due to the operation of ESS tools.

From 6 January to 28 February 2023 HMRC will be inviting businesses to make a disclosure that they have used till systems (such as ESS) to reduce their tax liabilities. If you make a notification in this way any penalties will be reduced.

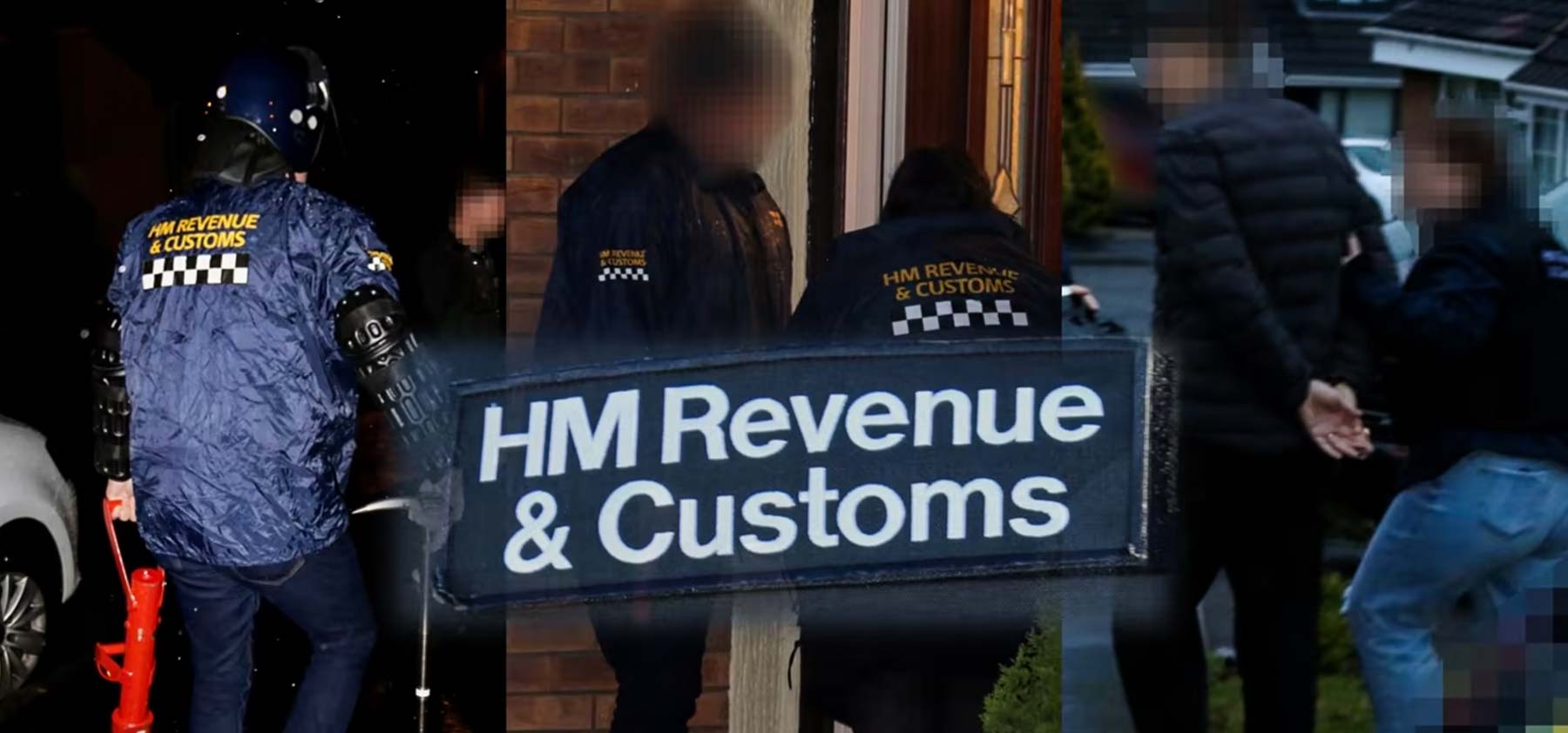

Last month HMRC‘s fraud department raided 90 businesses in the UK and arrested five people connected with ESS software sales. The penalty for supplying ESS tools can be up to £50,000, and that applies for each copy of the ESS tool supplied.

VAT late filing penalties

VAT registered businesses must now use MTD-compatible software to file VAT returns, as the old online form where you typed in your VAT figures has been closed.

To encourage businesses to file on time under the MTD regime the late filing penalties are being separated from the late payment penalties for VAT periods beginning on and after 1 January 2023.

Late filing penalties will be based on points awarded for each late submission. A penalty is levied only when the appropriate points threshold is reached, which depends on how regularly the return is filed:

– Annual returns – 2 points

– Quarterly returns – 4 points

– Monthly returns – 5 points

Taxpayers who file quarterly VAT returns will receive a flat £200 penalty on the fourth late submission. Each subsequent late filing will also trigger another £200 late penalty until the points slate is wiped clean by a period of perfect compliance.

Perfect compliance means being up to date with all outstanding VAT returns and filing current VAT returns on time for 12 months (6 months for monthly returns, 2 years for annual returns).

If you do not always file your VAT return on time because you regularly receive VAT repayments, you must do so in future. All late filed VAT repayment claims will attract points and penalties. There is no soft-landing for this new late filing regime.

Late VAT payments and interest top

The new penalty regime for late payment of VAT is fairer to those who miss the VAT payment deadline by a few days.

For Vat due in relation to periods beginning on and after 1 January 2023 you will have up to 15 days to pay, or arrange a time to pay agreement, without incurring a penalty. For the first year of this new system, you will have 30 days to pay the VAT liability in full instead of 15 days.

From 2024 onwards the new late payment penalties will be applied in two parts:

First penalty:

– 2% of the VAT unpaid at day 15; and

– a further 2% of the VAT unpaid at day 30.

If the payment is made after day 30 the first penalty will be 4% of the amount due. However, if full payment is made between days 15 and 30, this first penalty will be set at 2%.

Second penalty

From day 31 the penalty is charged daily, based on an annual rate of 4% of any outstanding amount.

Interest

The rate of interest applied for late payments of VAT will be the Bank of England base rate plus 2.5%. Interest will be paid on repayments at the Bank of England base rate minus 1%, subject to a minimum rate of 0.5%.

There is no carry forward of default periods or surcharge levels from the old VAT penalty system into the new late filing or late payment penalty regimes

January Questions and Answers

Q. We hire casual labour to work alongside our permanent staff over busy periods such as Christmas. If an individual works only one shift and earns say £90, do we need to add that person to the payroll to process their pay?

A:As you run a PAYE scheme to pay your permanent staff, you do need to include any casual labour in that payroll, even if you only pay the person on one occasion.

Q. I let out a room in my home to a lodger, and I also run my self-employed business from another room in the same property. When I sell the property, will I be taxed on a portion of the gain that relates to the rooms that have been used for my business and by the lodger?

A:The gain you make from selling your own home is generally free of capital gains tax (CGT) if you have occupied the property for the entire period of ownership, with an exception for the last nine months of ownership. You are right to assume that where part of the property is used for business purposes, a proportional amount of the gain may be taxable.

However, this only applies if part of the property is used exclusively for business purposes. Where your workroom is sometimes used for another purpose, say as a space for your children to do their homework, the room will not be exclusively used for business, so the gain on that portion of the house is exempt from CGT.

Where the lodger shares some living space with you, such as the kitchen, the letting of the room to the lodger is fully covered by the exemption from CGT.

Q. While I was unemployed, I trained to be an HGV driver. I have now been employed as an HGV driver. Can I claim the cost of the training course and the HGV licence against my wages to reduce the tax due on that income?

A:The tax law specifically allows you to claim a deduction for the cost of the HGV license and any medical examination you may have had to undertake in order to be granted that licence. However, you can‘t claim a deduction for the cost of the training course.

January Key tax dates

1 -Two new VAT penalty regimes, for late payment and late filing, come into effect for VAT periods beginning on and after this date.

31 – Last day to file self-assessment tax returns for 2021/22 without penalty.

The balancing payment of income tax and NIC due for 2021/22 must be paid.

Any capital gains tax due from gains made in 2021/22 must be paid if it was not already paid on account within 60 days of the disposal of residential property.

The first payment on account of income tax due for 2022/23 must be paid.

Where notice to file was issued after 31 October 2022, the tax payable date is extended to three months after the date on which the notice to file was issued.

Where HMRC has issued a determination to assess tax for 2018/19 this is the last day to file the outstanding 2018/19 tax return to displace that determination.

The balancing payment of income tax and NIC due for 2021/22 must be paid.

Any capital gains tax due from gains made in 2021/22 must be paid if it was not already paid on account within 60 days of the disposal of residential property.

The first payment on account of income tax due for 2022/23 must be paid.

Where notice to file was issued after 31 October 2022, the tax payable date is extended to three months after the date on which the notice to file was issued.

Where HMRC has issued a determination to assess tax for 2018/19 this is the last day to file the outstanding 2018/19 tax return to displace that determination.

Deadline to amend the 2020/21 self-assessment tax return, or file the late 2021/22 return to avoid a tax-geared penalty.

Last day to notify liability to class 2 NIC where the self-employment commenced in 2021/22.

Where taxpayer was subject to IR35 in 2021/22 this is the last day to correct the 2021/22 RTi return and pay the outstanding class 1 NIC with no penalties due.

Deadline for updating HMRC‘s trust registration service (TRS) for trusts that became liable to tax for first time in 2021/22 and for any notifiable changes in 2021/22.

Tax credit claims for 2021/22 can be amended up to this date to correct estimated figures submitted as part of claim renewal before 31 July 2022. If July deadline was missed tax credit claim can be renewed by this date if claimant can show ‘good cause‘ for delay.

Corporation tax returns for periods to 31 January 2022 must reach HMRC

Book a No-obligation Discovery Call

Book a No-obligation Discovery Call

Book a Free Discovery Call

Book a Free Discovery Call