As part of the 2024 Autumn Budget, the UK government has announced plans to consult on e-invoicing in early 2025. This move could transform tax reporting, increase efficiency, and help close the £9.5bn VAT tax gap—but is the UK’s infrastructure, and more importantly, are SMEs ready for this transition?

What is E-Invoicing?

E-invoicing is the process of exchanging structured, machine-readable invoices directly between systems, eliminating manual input and reducing errors. Unlike PDFs or paper invoices, e-invoices are digitally generated and automatically processed.

Potential Benefits of E-Invoicing:

- Reduces VAT reporting errors and improves compliance

- Speeds up payment processing and cash flow

- Lowers admin costs and reduces paperwork

- Helps combat tax fraud and non-compliance

Countries like Italy and Brazil have already implemented mandatory e-invoicing, seeing improvements in VAT collection, compliance, and reduced tax fraud. The UK could experience similar benefits, but there are major challenges to overcome.

Challenges: Are SMEs and HMRC Ready?

One of the biggest concerns is how SMEs will handle this transition. While larger companies have the resources to adopt new invoicing technologies, SMEs may struggle with:

- High setup costs for new e-invoicing software

- Staff training and process adaptation

- Integration with existing accounting systems

- Uncertainty around regulatory compliance

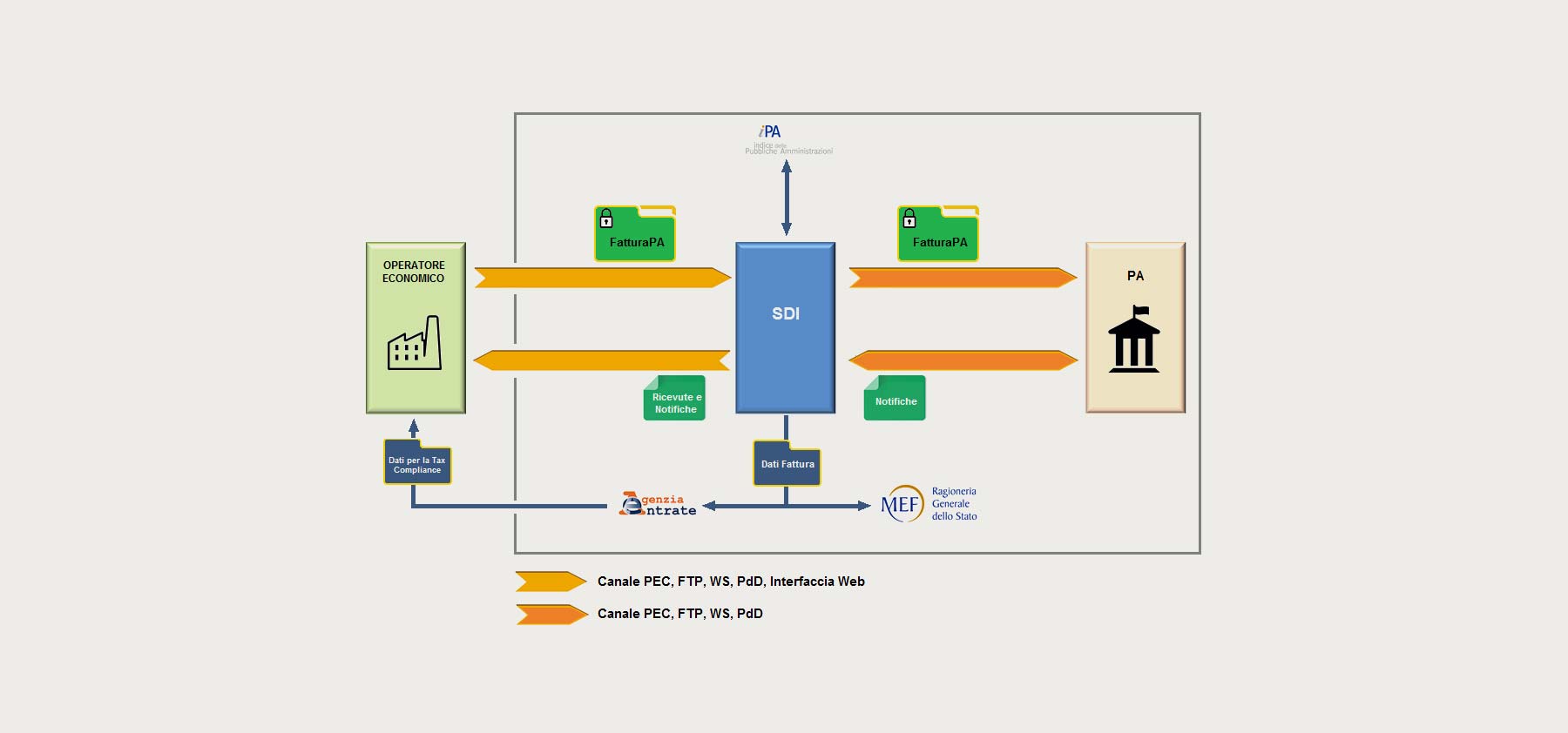

And what about HMRC? The UK tax system already has Making Tax Digital (MTD), but it has been plagued with delays and integration challenges. Unlike Italy, which built a centralized e-invoicing platform (Sistema di Interscambio – SDI), the UK still relies on multiple third-party software solutions, making implementation more complex.

Without a simplified, centralised system, there’s a risk that e-invoicing could become another compliance headache for businesses rather than a solution.

What Happens Next?

The consultation, expected to launch in early 2025, will seek feedback on:

- How to support SMEs in adopting e-invoicing

- Whether financial assistance or a phased rollout is necessary

- The best approach to ensuring all businesses benefit

What Should Businesses Do Now?

While e-invoicing isn’t yet mandatory, businesses that start preparing now will be ahead of the curve if requirements change. Here are some steps to consider:

- Review your invoicing processes – Are they manual or already digitised?

- Check software compatibility – Will your current accounting system support e-invoicing?

- Stay informed – Follow updates on the consultation and prepare for potential changes.

Have Your Say!

The government needs to hear from businesses of all sizes to ensure e-invoicing works for everyone, not just large corporations. The consultation is your chance to influence how this is implemented.

What do you think?

Will e-invoicing be a game-changer for efficiency and compliance, or will it create extra costs and complications for SMEs? Let’s discuss in the comments!

Book a No-obligation Discovery Call

Book a No-obligation Discovery Call

Book a Free Discovery Call

Book a Free Discovery Call